News

Altiplano Reports Results At Farellon For July 2021

August 26, 2021

EDMONTON, August 26, 2021 – Altiplano Metals Inc. (TSXV: APN) (WKN: A2JNFG) (“Altiplano” or the “Company”) is pleased to report on the July 2021 results from the Farellon Copper-Gold (Cu-Au) mine located near La Serena, Chile.

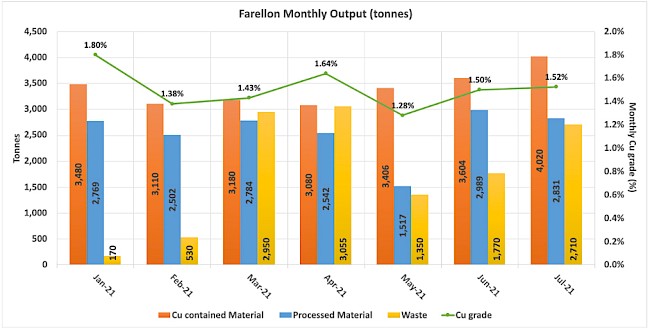

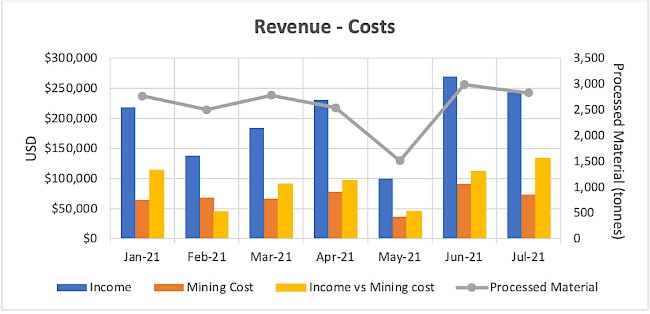

During July 2021, Farellon extracted approximately 4,020 tonnes of mineralized Cu/Au material at an approximate grade of 1.52% copper with shipments for processing totaling 2,831 tonnes. These figures represent a 11.5% improvement from June in tonnes extracted and a 2% increase in the copper grade. Revenue generated in July was approximately US$243,900 (after processing costs). Waste removal increased in July, reflecting the ongoing development work of the Hugo decline extension and preparation work for bench mining practices. At July month end, an additional 1,280 tonnes were stockpiled at site and will be shipped in August for processing.

CEO Alastair McIntyre commented “I am pleased to see that our positive July results highlight our focus on continuation of the upward trend in improved grade and increasing output while working in tandem with the ongoing development of our decline extension and sustainability work, such as the ventilation improvements.”

Figure 1. Comparative 2021 Monthly Review of Farellon Output

Figure 2. Monthly Processed Material, Income and Mining Cost at Farellon

Figure 3. Comparative 2021 Income, Copper Contained and Grade

| Month 2021 | USD Income* | Copper Pounds | Cu grade % |

| January | $218,695 | 104,741 | 1.77% |

| February | $137,990 | 68,806 | 1.38% |

| March | $184,028 | 83,974 | 1.43% |

| April | $230,655 | 88,053 | 1.64% |

| May | $99,614 | 39,330 | 1.23% |

| June | $269,442 | 93,277 | 1.49% |

| July | $243,853 | 90,654 | 1.52% |

*After processing costs

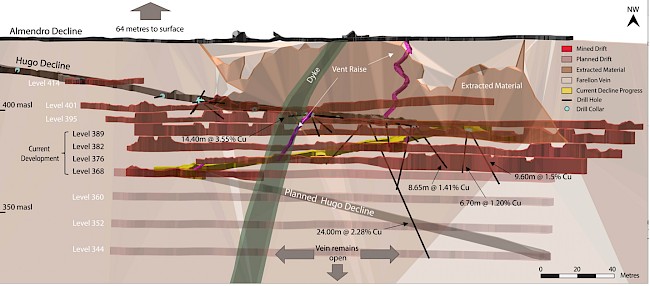

Figure 4. Illustration of Underground Operations at Farellon

The decision to re-commence production on the Farellon deposit is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and there is increased uncertainty and economic and technical risks of failure associated with the production decision.

During July, extraction of Cu/Au mineralized material focused on advancing the 376 SW and the 368 NE levels. Bench mining continued on the ceiling of level 389 SW and preparation for benching has begun on the 382 SW ceiling (Figure 4.). Development work on the Hugo Decline continues with the advance to the next access point at the 360 m level where to date, 70.5 m of the total 90 m required to reach the 360 m level have been completed. The decline advance is expected to be completed at the end of August where an additional advance of 22 m will be required to reach to the vein intersection. This additional work is expected be completed in September. The civil works for the new ventilation plan started with the closure of selected areas of the Almendro Tunnel to support the improved airflow through the Hugo Decline. In addition, the 125 HP fan platform has been installed with test phase preparation underway.

About Altiplano

Altiplano Metals Inc. (APN: TSX-V) is a Canadian mining company focused on developing and acquiring near term cash flowing assets and exploring for projects of significant scale. Altiplano’s goal is to grow into a mid-tier mining company through developing a portfolio of near-term production projects, cash flowing assets, and exploration projects focusing on copper, gold and silver. Management has a substantial record of success in capitalizing on opportunity, overcoming challenges and building shareholder value.

John Williamson, B.Sc., P.Geol., a Qualified Person as defined by NI 43-101, has reviewed and approved the technical contents of this document.

www.metalsgroup.com www.metalsgroup.com |

Altiplano is part of the Metals Group portfolio of companies. Metals Group is an award-winning team of professionals who stand for technical excellence, painstaking project selection, uncompromising corporate governance and a unique ability to pan through the rubble to discover and develop golden opportunities. |

ON BEHALF OF THE BOARD

/s/ "John Williamson"

Chairman

For further information, please contact:

Alastair McIntyre, CEO

moc.slatemnpa@mriatsala

Tel: (416) 434 3799

Jeremy Yaseniuk, Director

moc.slatemnpa@yymerej

Tel: (604) 773-1467

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the (TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address exploration drilling, exploitation activities and events or developments that the Company expects are forward-looking statements. A qualified person has not done sufficient work to classify any historical estimates as current mineral resources or mineral reserves and the issuer is not treating the historical estimates as current mineral resources or mineral reserves. The Farellon mine was previously in production dating back to the 1970’s with a reported historical production (to a depth of 70 m) yielding approximately 300,000 tonnes at an average grade of 2.5% copper and 0.5g/t gold. This material was processed locally and sold to ENAMI. Altiplano is relying upon past production records, underground sampling and related activities and current diamond drilling to estimate grade and widths of the mineralization to reactivate production. The decision to commence production on the Farellon deposit is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and there is increased uncertainty and economic and technical risks of failure associated with any production decision. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and title and delays due to third party opposition, changes in government policies regarding mining and natural resource exploration and exploitation, and continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedar.com.