News

Altiplano Provides Update on Mining and Processing Operations

February 13, 2026

EDMONTON, AB, February 13th, 2026 – Altiplano Metals Inc. (TSXV: APN) (WKN: A2JNFG) (“Altiplano” or the “Company”) is pleased to announce operational updates at the Santa Beatriz copper-gold-iron (Cu-Au-Fe) mine and the El Peñón Processing plant, located approximately 30 kilometers south of La Serena, Chile.

Highlights:

- Altiplano entered a short-term agreement with the mining contractor Andes Core Mining (ACM) to conduct mining and processing operations for the Santa Beatriz and El Peñón processing plant. The purpose of the agreement was to rent the operations providing APN the opportunity to receive rental income while benefiting from further mine development and plant optimization.

- ACM was to further develop the Santa Beatriz mine to lower levels intended to intersect higher grade sections of the mine. This area, supported by the previous drill program, was expected to provide new operating faces of the Iron Oxide Copper Gold vein.

- ACM was to also operate the plant to process the material mined at Santa Beatriz for the benefit of obtaining a rental fee while maintaining and sustaining the processing facilities.

- Commercial terms involved ACM paying APN US$8/tonne of material mined at Santa Beatriz. In addition, APN was to receive US$30,000/ month for the rental of the plant. ACM was to be responsible for all costs at each operation, mine rental fees and royalties, including personnel, mine development, sustainability and plant maintenance. ACM was provided the opportunity to sell the concentrate produced from the operations.

- For the months November to January a total of 3,953 tonnes were mined from Santa Beatriz, generating an income of US$31,625.

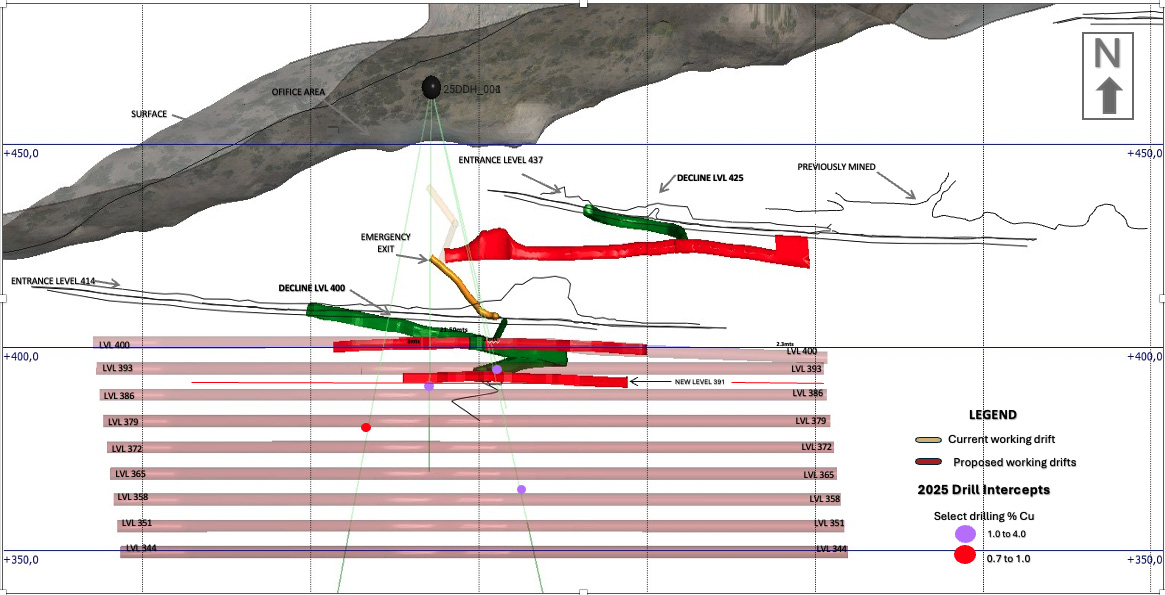

- Development was focused on the 425 m, 400 m and 392 m levels as outlined in Figure 1. Development was also conducted in the ceilings of the 400 m and 391 m levels

- Advancing to the 382 level, ACM reached a total of 30 of an expected 80 m

- This short-term arrangement has been suspended to review outcomes and consider strategic opportunities to generate improved shareholder returns. Both operations have been placed on short term care and maintenance while an optimization plan is currently under review.

President and CEO Alastair McIntyre comments: “The decision to use a contractor to develop the mine infrastructure to deeper levels focused on a cost-effective approach. It provided an opportunity to advance both assets while reducing operating costs and risk, with the potential of generating sustained income. The Company is now giving greater consideration to the rental concept and alternatives to improve returns. Operations have been paused while this strategic review is underway.”

Figure 1. Santa Beatriz Mine Section

The decision to develop the historical Santa Beatriz mine is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and there is increased uncertainty of economic and technical risks of failure associated with any potential production decision

Private Placement

The Company further announces the private placement announced on October 14, 2025 has been closed. The placement totaled 21,194,300 units (the “Units”) at a price of $0.05 per Unit, for total gross proceeds of $1,059,715. Each Unit consists of one (1) common share and one half (1/2) non-transferable share purchase warrant (the “Warrants”) of the Company. Each Warrant will be exercisable to acquire one (1) additional common share at a price of C$0.075 per share until December 19, 2027.

About Altiplano

Altiplano Metals is a Canadian exploration and mining company focused on gold, silver, and copper projects in the Americas. The Company has a diversified portfolio of assets that include exploration properties, a developing copper/gold/iron mine and an operating copper/gold and iron processing facility. Altiplano is focused on developing safe and sustainable production, reinvesting into exploration and development, and pursuing acquisition opportunities to provide scalable upside opportunities. Management has a substantial record of success in capitalizing on opportunity, overcoming challenges and building shareholder value

Qualified Person

The technical content of this news release has been reviewed and approved by John Williamson, P.Geol., a Qualified Person as defined by National Instrument 43-101. Mr. Williamson is a Chairman and Director of Altiplano Metals Inc. and is not independent of the Company.

ON BEHALF OF THE BOARD

/s/ "John Williamson"

Chairman

For further information, please contact:

Alastair McIntyre, CEO

moc.slatemnpa@mriatsala

Tel: (416) 434 3799

|

|

Altiplano is part of the Metals Group of Companies, led by a dynamic group of resource sector professionals with a long record of success in evaluating and advancing mining projects from exploration through to production, attracting capital, and overcoming adversity to deliver exceptional shareholder value. |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the (TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address exploration drilling, exploitation activities and events or developments that the Company expects are forward-looking statements. A qualified person has not done sufficient work to classify any historical estimates as current mineral resources or mineral reserves and the issuer is not treating any historical information or estimates as current mineral resources or mineral reserves. The Santa Beatriz mine was previously in private production mid 2010’s with unknown production records. This material was processed and sold locally to a private processing facility. Altiplano is relying upon limited past production records, underground sampling, surface drilling and related activities to further explore, develop and potentially mine Santa Beatriz. The decision to develop the project and extract material for processing is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and there is increased uncertainty and economic and technical risks of failure associated with any future potential production decision. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and title and delays due to third party opposition, changes in government policies regarding mining and natural resource exploration and exploitation, and continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedarplus.ca.