Overview

PASTILLAS

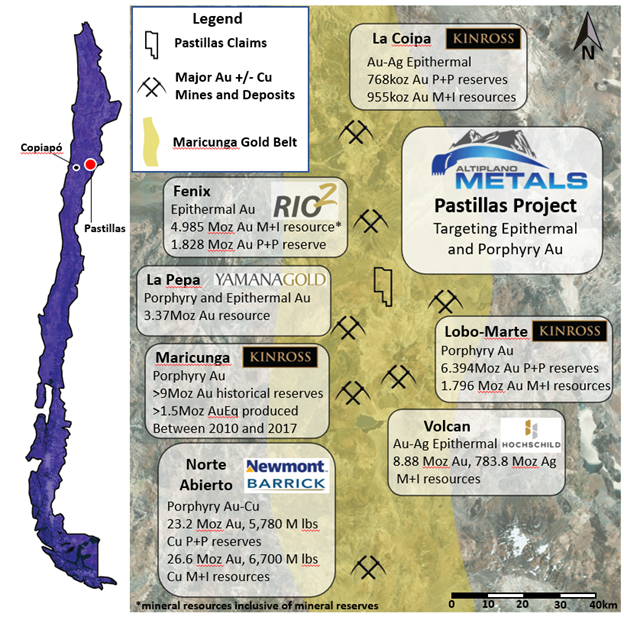

MARICUNGA GOLD BELT - ATACAMA, CHILE

Location/Introduction

The Pastillas project is located approximately 115km east of Copiapo, in the Atacama Region of northern Chile (Figure 1). Acquired in early 2021, Pastillas is an undrilled and underexplored 3,100-hectare land package with high upside and numerous world-class deposits in close proximity. Access to the Property is straightforward given its proximity to the International Highway to Argentina.

Regional Geology

The Property is situated within the prolific Maricunga Gold Belt, a Miocene-aged magmatic arc setting with gold endowment >100 Moz in past production and current reserves and resources. Deposits in the region contain both high sulphidation Au ± Ag epithermal (e.g. Fenix deposit 20 km to the north, 4.985 Moz Au reserves and resources1) and Au ± Cu porphyry (e.g Lobo-Marte 13 km to the southeast, 8.190 Moz Au reserves and resources2) mineralization styles.

Project Geology

The Property is predominantly underlain by mid- to late-Miocene intermediate volcanics and volcaniclastics, intruded by later dacite domes, with ages consistent with productive magmatic cycles in the Maricunga Gold Belt (24-20 Ma and 16-12 Ma). Evidence of hydrothermal activity includes widespread steam-heated alteration, opaline silica-alunite, and a horizontal chalcedonic level that may indicate paleo-water table (Figure 2 annotated photo?). Widespread alteration identified in ASTER data has been confirmed in geological mapping and in SWIR data. The presence of argillic and advanced argillic alteration, coupled with the large steam-heated footprint and evidence of paleo-water table, is consistent with a high-level expression of epithermal mineralization within the region and may also indicate the potential for porphyry mineralization at depth.

Mineralization

Limited rock sampling has yielded up to 26.5 ppb Au and anomalous values in several important pathfinder elements, typical of shallow erosion levels in analogous mineralized systems and consistent with Altiplano’s exploration model.

Terms of the Agreement

Under the terms of the Agreement, Altiplano may acquire a 100% interest in the Property by paying a total of US$1,230,000 in cash and issuing 1,000,000 in common shares of the Company over four years, as follows:

- US$30,000 and 50,000 shares within 5 business days of the date of acceptance of the Agreement by the TSX Venture Exchange (the “Approval Date”).

- US$50,000 and 100,000 shares on the first anniversary of the Approval Date.

- US$100,000, and 150,000 shares on the second anniversary of the Approval Date.

- US$250,000 and 300,000 shares on the third anniversary of the Approval Date.

- US$800,000 and 400,000 shares on the fourth anniversary of Approval Date.

In addition, the Company must incur on the Property a minimum total of CND$2,900,000 in exploration expenditures over the next 4 years, as follows:

- $150,000 within the next 12 months from the date of the Agreement;

- $250,000 within 12 months of the first anniversary date of the Agreement;

- $1,000,000 within 12 months of the second anniversary date of the Agreement; and

- $1,500,000 within 12 months of the third anniversary date of the Agreement.

The Agreement also provides a 2.0% NSR retained by the optionor with a provision for the Company to buy back one-half (reducing to a 1% NSR) for US$2,000,000 until the 8th anniversary of the Agreement.

- Mining Plus, Amended and Restated Pre-feasibility Study for the Fenix Gold Project, August 15th, 2019.

- Kinross 2020 Annual Mineral Reserve and Resource Statement